Zhong Lun advised Credit Agricole Corporate and Investment Bank and HSBC on the deal. Credit Agricole Corporate and Investment Bank and HSBC has granted a cross-border...

Provident Capital and Saratoga Group’s Cross-Border Facility

Via 40 Express’s $192 Million Financing of Bogotá-Girardot Third Lane Construction Project

Philippi Prietocarrizosa Ferrero DU & Uría advised the banks on the transaction Via 40 Express secured a $192 million credit facility from Credit Agricole Corporate and...

Tikehau Capital’s €500 Million Sustainable Bond Issue

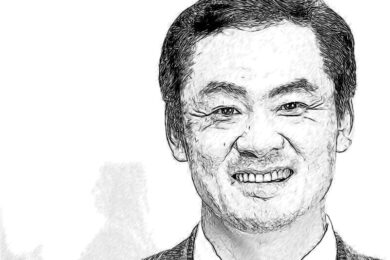

IN BRIEF: Clifford Chance, Linklaters, advised on the matter. Clifford Chance advised Tikehau Capital Partners with a team including C?ric Burford (Picture – Debt Capital Markets)....

Agos Ducato S.p.A.’s €1.4 Billion STS Securitization

IN BRIEF: Allen & Overy, Legance, advised on the matter. Allen & Overy advised Agos Ducato with a team including Stefano Sennhauser (Debt Capital Markets). Legance...

Woori Card’s $200 Million Senior Unsecured Notes Offering

Simpson Thacher represented the joint managers in the offering. Woori Card Co., Ltd. (“Woori Card”) executed its offering of US$200 million 1.75% Senior Unsecured Notes due March 23,...

Berlin Hyp’s €500 Million Green Bond Offering

White & Case advised the underwriters on the offering. Berlin Hyp executed its €500 million Green Pfandbrief issue. The issuer intends to use the net proceeds exclusively...

BPER Banca’s €500 Million Social Bond Offering

Baker McKenzie assisted the joint lead managers on the deal. BPER Banca issued € 500 million Fixed to Floating Rate Senior Preferred Notes due March 2027, under the...

Crédit Mutuel Arkéa’s €500 Million Senior Non-preferred Social Bonds Issuance

IN BRIEF: Gide Loyrette Nouel, advised on the matter. Gide Loyrette Nouel advised Crédit Agricole Corporate and Investment Bank with a team including Hubert du Vignaux...

Crédit Agricole Italia’s €500 Million Green Covered Bond Offering

IN BRIEF: Chiomenti, advised on the matter. Chiomenti advised Crédit Agricole Corporate and Investment Bank, Crédit Agricole Italia, DZ BANK AG, Intesa Sanpaolo S.p.A., Natixis, Norddeutsche...

PAI Partners’ Financing of the Acquisition of Euro Ethnic Foods SA

IN BRIEF: Allen & Overy, Linklaters, advised on the matter. Allen & Overy advised Bank of America, Banque Populaire Auvergne Rhône-Alpes, Crédit Agricole Corporate and Investment...

Rénault’s Selling of its Stake in Daimler AG for €1,143 Billion

IN BRIEF: Gide Loyrette Nouel, White & Case, advised on the matter. Gide Loyrette Nouel advised Renault SA with a team including Melinda Arsouze (Equity Capital...

Intesa Sanpaolo S.p.A.’s €1.25 Billion Green Bond Senior Preferred Offering

IN BRIEF: Clifford Chance, advised on the matter. Clifford Chance advised Alpha Bank, Banco Bilbao Vizcaya Argentaria (Bbva), Bank of Montreal, Bankinter (Banco Intercontinental Español), Barclays...